Plastribution’s Polymer Price Know-How: April 2024

- Dan Russell

- April 19, 2024

- 16 minutes read

|

Getting your Trinity Audio player ready...

|

Plastribution’s April Polymer Price Know-How shows the market looking for balance amid fluctuating feedstock costs and logistical challenges due to geopolitical tensions affecting the Red Sea route. Despite these pressures, most polymer categories managed to maintain stable prices, though specialised grades like European PP are experiencing tighter supply dynamics. This report examines these conditions and their implications on strategic procurement in the polymer industry.

Prices in the polymer market look somewhat rangebound. Much that sellers would like to increase prices to cover increased feedstock costs, and the expense of shipping goods around the Cape of Good Hope, in order to avoid the terrorist issues affecting the Red Sea route, buyers appear to be able to secure materials at favourable prices. Perhaps, what is noticeable is that many of the low-price bargains have disappeared from the market and this has caused the polyolefin and styrenic baskets to tick up slightly.

A potential exception in this situation is PP, where the combination of restricted feedstock, and limited availability of the more specialised grade slate, which tends to be more oriented to European polymer production, may give sellers strong enough supply/demand fundamentals to push through further increases. The tighter supply of PP may be a situation that the market may have to adjust to, as the increased penetration of US-origin PE, will dampen demand for EU-produced ethylene from expensive Naphtha, from which C3 is a co-product for PP production.

The engineering polymer and styrenic polymer markets remain steady, with demand remaining moderate from key automotive, E&E and industrial sectors.

There is some suggestion that packaging markets are starting to improve, as destocking throughout the whole supply chain finally starts to ease.

Crude oil prices look set to increase further with some players forecasting that Brent Crude could soon hit $95 per barrel, on the back of supply concerns. Clearly further crude oil cost increases are likely to be reflected in feedstock costs, which in turn will place inflationary pressure on polymer producers.

Exchange Rates

€- 1.17

$- 1.27

€/$- 1.09

Polyolefins

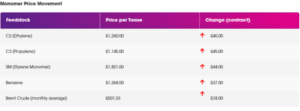

Polyolefin prices are quite mixed in April with different approaches depending on the supplier and the grade. Despite monomer increases of +€40 / MT on Ethylene C2 and +€45 / MT on Propylene C3, most suppliers adopted a rollover position as availability improved and demand remained muted. However, some suppliers did still push for a monomer increase citing poor availability from their own limited production. This appears to be limited to PP as European supplies continue to be impacted by Force Majeures and reduced output. PE supply is, however, quite good with low-cost imports starting to appear giving the buyer a stronger hand than in recent months.

Because of these imports, LLDPE and HDPE grades are under price pressure and are seeing discounts from March levels. However, many buyers expected these reductions and held off buying in March, so demand is perhaps slightly better than expected as some look to replenish low stocks.

Outlook into May and June is for relatively good availability to keep prices under pressure with further slight reductions expected.

We should keep in mind that there are some potential uncertainties soon that can upset availability of both raw materials (monomers) and polymers. Several cracker shutdowns in Europe have been announced recently that will affect monomer production locally. We also see an uncertain situation in geopolitics that could affect oil pricing.

The US Hurricane season typically starts in June and reports suggest this year could be a bad one impacting availability of imports, particularly on LLDPE and HDPE

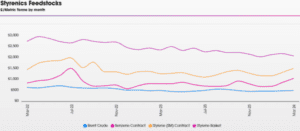

Styrenics

Small Rise for Contract Styrene, Polymer prices stable.

Styrene Monomer has risen again, settling at €1821/T, an increase of €44/T from March.

For April, EU GPPS and HIPS has shown a small increase or rolled over, with EU ABS showing slight increases. Deep sea materials are steady. Prices are expected to remain high until May at the earliest, where a reversal could begin.

GPPS/HIPS/ABS supply chains are still running very low. Polymer producers have been running output at a minimum due to poor demand, and converters and distributors running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

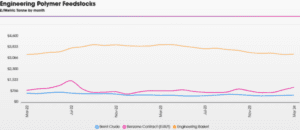

Engineering Polymers

Prices increasing for most engineering materials, but demand remains weak especially in the automotive sector so these rises could prove difficult to pass on.

The Benzene contract for April increased by a further €37/MT to €1268/MT, the highest level it has been since July 2022.

Sustainable Polymers

Most recycled materials have seen around rollover in April in line with prime prices generally moving in that direction.

Recycled LDPE / LLDPE

Most materials continue to be impacted by the challenges of the Red Sea situation. Prices are rising due to this and increased costs for raw materials.

Recycled HDPE

HDPE also typically rolled over with some reports of deals available as availability continues to be good with demand dropping in the face of much improved prime supply.

Recycled PP

PP typically saw rollover with some movement either side. Clear grades suitable for consumer packaging continued to command significant premiums over prime and in some cases continued to rise this month. More “industrial” grades continued to see slightly muted demand and good availability. Some deals for volume were reported with reductions.

Price Know-How: April 2024 Full Report

Visit the Price Know-How website to read the April 2024 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.