Polymer Price Know-How: January 2023

The leading polymer distributor, Plastribution, has released the latest instalment of Price Know-How. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, sales are expected to be protracted, and the scale of the feedstock price reductions was greater than expected. However, polymer producers are working hard not to pass through the full reduction in monomer pricing.

Overview: January 2023

Olefins and Aromatics move in opposite directions as 2023 gets underway

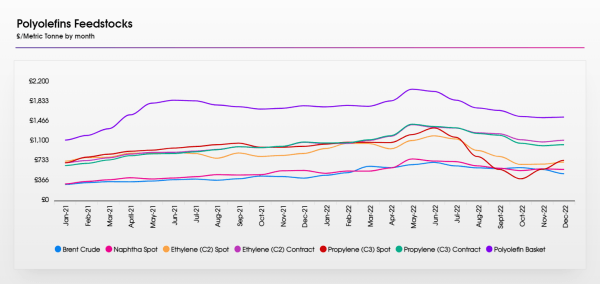

The prompt settlement of the C2 (Ethylene) and C3 (Propylene) on January 3rd was, for many, a bit of a shock. Whilst the United Kingdom enjoyed an extra public holiday due to New Year’s Day falling on the weekend, most of Western Europe had already returned to work on Monday. The scale of the feedstock price reductions was greater than expected, however the fall in Brent Crude was at a similar level.

As polypropylene and polyethylene sales started to get underway, it quickly became clear that polymer producers are working hard not to pass through the full reduction in monomer pricing. Poor margins were cited as a reason for this, alongside the continuing high cost of energy required to produce polymers.

Sales in January tend to be protracted, with sellers typically buying on an as need basis until a degree of normality returns from February. Sellers may have a better opportunity to ‘tune’ prices through the month to achieve a satisfactory price/volume balance. Concerns about underlying demand persist throughout the supply chain and this creates a dovish sentiment amongst may sellers.

In the case of aromatic feedstocks, it appears that a reduced level of benzene imports into Western Europe during December is pushing pricing upward as buyers chase available volumes. The increase in benzene has mainly passed through into Styrene Monomer. As a consequence, styrenic polymer producers will be pushing increases of a similar scale.

Producers of engineering polymers will also give thought to how it may be possible to recover this inflationary factor in a market where demand remains lacklustre.

Polyolefins

January saw falls almost in line with the monomer drop of €95 / MT for both C3 Propylene and C2 Ethylene. Some Producers limited reductions to €50 / MT citing continued high energy costs and some sought compromises around €70 / MT. Market is still quite muted with many buyers having sufficient stocks and have no challenges in securing material.

Outlook for February is for relative stability. Expectations on monomers are mixed with some expecting an increase on the back of higher Naphtha prices but others see oversupply, especially on Propylene C3, that indicates small decreases. With no restrictions on polymer availability and with demand low on the back of general economic concerns, there is little chance of prices moving back up.

Some industry talk of further attempts to limit production in Europe as producers selling at levels to compete with imports of HDPE etc. are in very negative margin territory. The outlook for the coming months is also dependent on how much China demands when they return from Lunar New Year celebrations.

Styrenics

Engineering Polymers

Price Know-How: January 2023 Full Report

Visit the Price Know-How website to read the January 2023 update, including an in-depth analysis of each market segment and material group by Plastribution’s expert product managers.

Subscribe and keep in the know

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!

To subscribe for free and receive monthly updates directly to your inbox please click here.

Plastribution

+44 (0) 1530 560560

Website

Email