Plastribution’s Polymer Price Know-How: January 2025

|

Getting your Trinity Audio player ready...

|

Plastribution’s January Polymer Price Know-How highlights a market with inflationary pressures and a stronger USD, as global crude oil prices continue to rise. While ample supply kept polymer prices steady at the start of the year, the outlook for February suggests potential increases in PE and PP costs, driven by expected hikes in C2 and C3 monomer prices. European styrenic polymers have already seen price rises, and higher import costs due to currency shifts and reduced availability of Deep Sea imports are adding to the complexity of the market. As converters navigate weak demand and financial constraints, the first quarter of 2025 promises a challenging and uncertain landscape.

What will increase feedstock costs and a stronger USD mean for polymer prices?

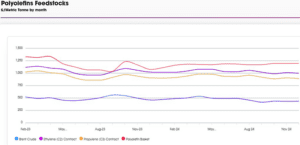

Activity in the UK polymer market came to an early close in December, with most transactional activity ending by the middle of the month. With plentiful supply across the full range of polymers, there was no real appetite for pre-buying. Subsequently, January has got off to a typically slow start, with the expectation that plastic converters will meet their needs on a day-to-day basis.

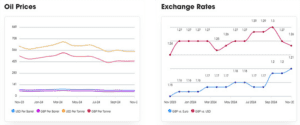

In the background, inflationary pressures continue to mount with both a gradual uptick in global crude oil prices and a fall in the value of the GBP against other major currencies which results from concerns about the state of the UK economy.

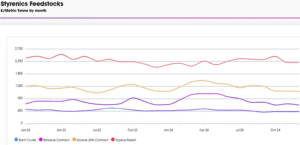

If the increase in crude oil price is maintained throughout January, then it is likely that C2 and C3 contract prices will increase for February, resulting in price increase nominations for PE and PP. The increase in SM pricing has already resulted in price increases for January shipments of styrenic polymers from European producers.

Exchange Rates

€- 1.21

$- 1.26

€/$- 1.05

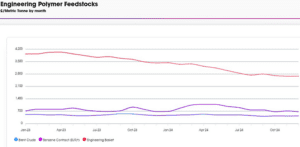

Engineering Polymers

The start of the new year has been slow, demand remains extremely poor across most materials and market sectors. Inventories are heavily stocked, and prices continue to fall for most polymers apart from PMMA. The January benzene contract settled €45/Mt higher than December at €857/Mt.

Sustainable Polymers

Recycled Polyolefins have mostly rolled over in January alongside prime prices. Some recent plant closures in the UK and Europe are helping to bolster pricing at the lower levels as supply is slightly restricted. Buyers are facing the realisation that they can’t keep buying at a lower-than-cost level and expect their suppliers to remain in business. New legislation is expected to keep prices stronger in 2025.

Recycled LDPE / LLDPE

Recycled LDPE / LLDPE has mostly rolled over in January. High-quality grades continue to see strong demand and restricted availability leading to prices above virgin.

Lower quality grades are seeing better pricing than in recent months as supply is slightly limited after extended Christmas shutdowns.

Recycled HDPE

Recycled HDPE is typically rollover and is seeing some slight increases at the lower end with supply slightly restricted.

Natural grades for consumer packaging continue to see significant premiums over virgin prices.

Recycled PP

Recycled PP is rolling over in January and as with recycled PE, the very lowest prices offered last year are gone as recyclers need to return to making a margin.

Natural grades continue to command strong premiums over virgin, particularly in consumer packaging applications.

Price Know-How: January 2025 Full Report

Visit the Price Know-How website to read the January 2025 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.

+44 (0) 1530 560560

Website

Email