Plastribution’s Polymer Price Know-How: August 2025

|

Getting your Trinity Audio player ready...

|

Plastribution’s August 2025 Polymer Price Know How discusses how recent global events and their effect on the polymer market. August saw polymer prices stagnate as easing monomer contracts were offset by rising crude oil and a weaker GBP, leaving input costs broadly neutral. With supply still abundant, converters secured rollovers or discounts, while producers eye September for potential hikes amid hopes of tighter availability and improved demand.

Opposing price inputs lead to further price stagnation, but producers may push for increases in September.

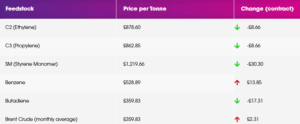

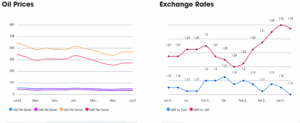

Whilst all August contract monomer prices, except Benzene, marginally eased for August, increased spot crude oil prices and GBP exchange rate weakness brought inflationary pressures to polymer pricing.

Overall, with no dominant factors, the result is basically neutral from an input cost perspective. These factors were of little relevance as polymers remain in plentiful supply, and so plastic converters have been able to shop around to find material at price rollovers from July, with the occasional discount to be found where sellers are eager to shift volumes or generate cash.

As the seasonal holidays start to draw to a close, thoughts will turn to the price action for September with the expectation that polymer producers will be contemplating price increases for standard polymers with the expectation that demand will increase, and availability tightens.

It remains to be seen if a bullish approach is taken to price increase announcements, or if a more tentative commercial strategy is adopted. Ultimately, the supply/demand balance will continue be a key factor in determining how price evolves. With the likelihood that crude oil prices and feedstock input costs will continue to be weak and therefore unsupportive in terms of price inflation.

Monomer Price Movement

Exchange Rates

€- 1.16

$- 1.35

€/$- 1.17

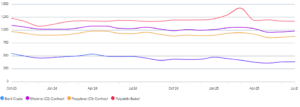

Standard Polymers

August appears to be around rollover for both PE and PP. Although both Ethylene and Propylene Monomers reduced by €10 / MT, producers appear to be resisting calls for further drops having seen their margins erode significantly this year already.

If we compare pricing to this time last year, PE is roughly €170 / MT lower whilst Ethylene is only €115 / MT lower. PP Homopolymer is roughly €270 / MT lower whilst Propylene is only €120 / MT lower. Not a sustainable business for many producers of PP in Europe.

We continue to see further talk of rationalisation within the industry as European Producers continue to post losses in the face of some very challenging market conditions. Market demand continues to be weak couped with new production capacities on stream. In the first 5 months of 2025, the EU increased imports of PP by 12%.

Outlook for the coming months is largely expected to be around rollover, as there is little indication of a change in market conditions. There were some expectations of a rally in September, but as oil has dropped back from the highs at the end of July, there appears to be no suggestion of movement in monomer, and without a change in the supply / demand balance, we can expect prices to stay quite flat in the short term.

Polyolefins Feedstocks

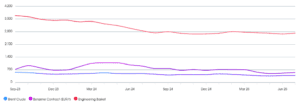

Performance Polymers

The UK market for performance polymers remains poor, with low demand and excessive stock levels. Imports from Asia remain high, and as a result of these factors, many European producers are continuing to cut production during the holiday period. There was renewed efforts by some manufacturers to try and push small price increases through; however, with the ongoing weak demand and the global oversupply situation, most polymer costs softened yet again.

The July benzene contract settled at €637/t, an increase of €26/t from June, whilst August sees yet another small increase of €16/t, with the price settling at €653/t. This may start to impact some materials as the year progresses.

Engineering Polymer Feedstocks

Sustainable Polymers

Recycled Polyolefins have largely seen a rollover in August and for some grades, slight increases. Whilst demand is still relatively weak, further announcements of closures of recycling facilities both in the UK and in Europe are helping to shift the conversation around pricing.

Recycled LDPE / LLDPE

Recycled LDPE / LLDPE is up slightly on the higher quality grades, black and grey appear to be closer to rollover.

Recycled PP

Recycled PP has seen around rollover in August.

Recycled HDPE

Recycled HDPE has typically rolled over in August; the market appears to be relatively stable.

Price Know-How: August 2025 Full Report

Visit the Price Know-How website to read the August 2025 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.