Plastribution’s Polymer Price Know-How: 2023 Review

- Dan Russell

- January 25, 2024

- 36 minutes read

The global economy faced a slowdown marked by fluctuating energy prices, geopolitical tensions, and evolving market dynamics. In this 2023 roundup, Plastribution delves into the year’s key trends, from the polymer markets’ shifting prices to the UK’s economic resilience post-Brexit and post-COVID-19, offering a comprehensive overview of a year marked by challenges and adaptations.

Executive Summary

The effects of the global economic slowdown dominated the economy in 2023. Relatively high levels of price inflation present in the first half of the year started to moderate towards the end. In addition to the continuing conflict between Russia and Ukraine, the terrorist attack by Hamas on Israel and the subsequent conflict in Gaza raised geopolitical tensions in the Middle East. At the very end of the year, Houthi terrorist action against commercial shipping in the Red Sea raised concerns about supply chain security and shipping costs. Energy prices moderated from the hiatus in 2023.

In the polymer markets, the price trend continued to be lower. All sectors witnessed supply exceeding demand, which, for many materials, was exacerbated by producer capacity increases. A slight price upswing for volume polymers in the Autumn was not sustained as producers fought hard to win available volumes.

Prices have now fallen to the extent that polymer producers termed the situation ‘bottom of cycle economics’, resulting in the idling and closure of plants where the financial performance is no longer viable. This effect was more pronounced in Western Europe due to the higher cost of operating polymer plants in this region, which will inevitably result in a greater dependence on imports.

In the energy sector, the global recession risk continued to outweigh geopolitical concerns that could affect the oil and gas supply. Even the disruptions caused to shipping routes by the actions of the Houthi rebels at the end of the year had negligible impact on pricing, as markets believed domestic inventories were sufficient to cover any shipment delays.

Despite the challenges of 2023, the UK plastics sector has once again demonstrated resilience in the face of significant challenges.

UK Economy, Brexit, and Post-COVID 19 Pandemic

Contrary to the expectations of many economists, the UK avoided recession in 2023, and modest growth was reported. Inflation was a dominant issue, with RPI and CPI peaking above 10% before moderating towards the end of the year.

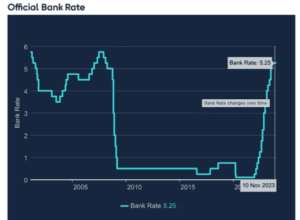

For plastic converters, the falling cost of raw material inputs mitigated the impact of inflation. Interest costs have peaked at a 5.25% Bank of England rate. There is evidence of lenders in the domestic mortgage sector becoming more competitive to secure business.

Understanding the fundamentals of demand in the post-COVID-19 era remains a challenge; it is clear that there was a significant move in consumer spending towards consumer durables during the lockdown periods.

Since COVID-19 restrictions have lifted, consumers have relied upon their previous investments in goods and continue to prioritise spending on leisure activities such as holidays and dining out. Given long lead times on goods sourced from Asia, the drop in demand resulted in a glut of products. When this is combined with moving back to ‘just in time’ from ‘just in case’ purchasing strategies, it is almost impossible to understand the underlying demand.

As a result of low demand, destocking and the move to ‘just in case’ purchasing, the UK Manufacturing PMI fell month on month throughout 2023.

Logistics

Since the extreme inflation in East-West container shipping rates peaked in mid-2022, prices fell back to more than expected in 2023, as illustrated in the table below. High shipping costs in typical polymer prices can become prohibitive for raw material imports. They can become a barrier from the perspective of importing more competitively priced polymers from other regions of the world.

Spot container shipping rates from Asia and the Middle East increased rapidly at the end of the year due to the hijacking attempts by Houthi rebels on ships passing through the Red Sea, the subsequent increase in shipping times, and the consequent reduction in container shipping capacity.

The shortage of HGV drivers in the UK has eased significantly, with more drivers and the economic slowdown contributing to better resource availability.

Exchange Rates

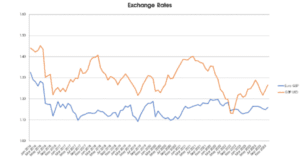

Following the short-lived Liz Truss premiership and the ensuing Kwasi Kwarteng autumn statement/’mini budget back in 2022, the value of the GBP has recovered significantly, achieving a reasonable level of stability against the Euro and gains against a slightly weaker USD.

The result of the June 2016 Brexit referendum has permanently impacted the value of the GBP, with the value against the Euro dropping from the 1.30’s to the 1.10’s. The USD turbulence is more related to political and economic developments within and outside the US.

In the last 15 years, interest rates in the UK have increased significantly as the Bank of England takes action to reduce inflation from the current rates to the target level below 2%.

Whilst the objective is to reduce consumer spending, businesses that raise working capital through borrowing also face significant increases in the cost of financing.

Crude Oil

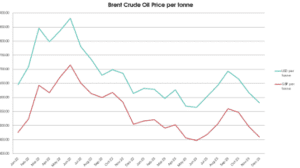

Brent Crude traded in a relatively tight range of 75 – 90 USD per barrel. Prices fell until mid-2023 before a short rally over the summer months and then fell sharply back to levels that were below those at the start of the year.

The reaction of crude oil prices to the issues in the Red Sea area at the end of the year was relatively muted, with a view that domestic inventories and increased supply from Saudi Arabia would be sufficient to smooth any disruption.

Feedstock

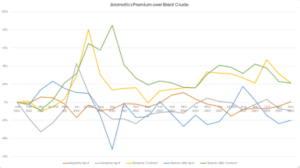

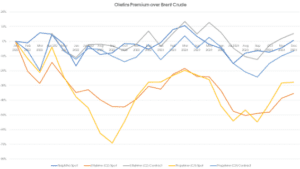

The volatility of aromatic feedstock continued in 2023, with both Benzene and Styrene monomers recording significant swings, often independent of Brent Crude and Naphtha. The olefin situation was dominated by over-supply, with spot prices trading at a substantial discount to the contract values.

In the case of C2, high import penetration of competitively priced PE suppressed demand. Although C3 is typically a coproduct of Naphtha cracking from C2 production, the reduction was insufficient to avoid a glut of C3 and, hence, the significant discounts for spot purchases.

Such was the state of demand for polymer raw materials that producers were typically forced to pass through monomer discounts in total, with polymer converters naturally resisting complete monomer increases and often being able to achieve discounts more significant than monomer as competition for available volumes was intense.

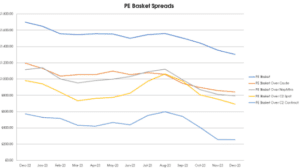

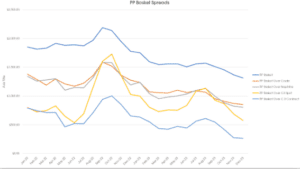

The graph above confirms the oversupply of C2 and C3, with spot volumes selling at significant discounts versus Naphtha. Even contract monomer margins were dragged down by spot pricing, especially for C3 in the late summer period.

The graph below clearly illustrates the relative volatility of aromatic feedstocks, with periods of discount and significant premium. The past year has been more stable, with SM peaking in August due to supply restrictions.

PVC – Suspension & Emulsion

Competition in the S-PVC sector was intense, with volumes from the USA offering the best value. The US is advantaged in terms of C2, derived from the ethane contained in shale gas, and with low electricity costs, which is essential for the energy-intensive process needed to produce chlorine.

The economics of PVC production in Europe has become so bad that producers are seeking support from EU authorities and are considering pushing for anti-dumping duties.

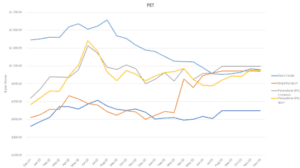

PET

The dynamics of the PET market are complex, with the following factors all having the potential to impact pricing significantly:

- PET pricing, the demand for which is rapidly increasing as pressure from consumers, retailers, and brands escalates. These pressures are enhanced by the UK plastics packaging tax and similar legislation being implemented in other countries.

- Use PET in the textiles market, where PET is commonly substituted for natural cotton whenever this crop is scarce and prices inflate.

- Seasonal demand for carbonated drinks is heavily influenced by weather conditions, with high temperatures typically increasing demand.

The supply of prime virgin PET was highly competitive, with low-price imports from Asia dominating the price action. Ineos announced the closure of significant capacity for PTA, a precursor to PET production.

As with S-PVC, European producers of PET have raised concerns about dumping in the European market, in this case citing India and China as sources of unfair trade.

Polyolefins

With the exception of a couple of minor upward blips in April and November, the price trend was fundamentally downward for the polyolefins basket. Polymer converters were able to exploit the intense competition among suppliers to their advantage.

Polypropylene and polyethene pricing coincided by the end of Q1 2023, and this is due to several factors, including:

- A relative reduction in the C3 price compared to the C2 price

- PP producers taking advantage of the low C3 spot pricing

- Lower production and demand for consumer durables such as cars and white goods, for which PP is a much more significant market segment than PE.

The supply of PE from the USA that resumed in 2022 became a dominant factor in 2023, with a strong flow of materials for film extrusion and blow moulding arriving at competitive prices. UK converters have become accustomed to the longer lead times and consequently need to make forward price commitments often to secure supply.

Styrenics

2023 was a relatively stable year in terms of styrenic polymer pricing. The late summer increase in crude oil pricing passed through to selling prices, with prices falling away towards the end of the year.

Engineering Polymers

The engineering polymers market reflected the broader global economic situation, with prices sliding throughout the period. The high level of competition for available volumes eroded producer margins.

UK Economic Outlook

The UK General Election, likely to be held in the second half of the year, will be a significant factor affecting the UK economy, before which a budget in March may offer some economic stimulus through lower taxation rates at either a personal or corporate level. Forecasts from the UK manufacturing sector are robust, with growth anticipated. Some recovery in the consumption of consumer durables is likely as consumer behaviour returns to a more normal pattern.

The UK Government continues to review the UK REACh legislation and has already extended the registration deadlines. Consultation that took place in 2023 may result in further changes, and it is anticipated that registration fees are set to be lowered.

Logistics

The increased shipping time from not using the Red Sea and Suez Canal route effectively reduces shipping and container capacity. It has caused a significant spike in spot container shipping rates. While the effect on pricing is not likely as severe as in 2022, some polymer converters are facing shortfalls in supply at the start of 2024. If the situation in the Red Sea is resolved, there will be a consequent reduction in shipping times and the risk of a supply glut.

On the domestic front, the issue with a shortage of HGV drivers appears to have eased, and even in the final quarter of 2023, when seasonal demand was high, there were no significant issues.

Logistics cost inflation appears to be easing due to a reduction in demand for physical storage as the inventory glut from the end of the COVID-19 era continues to diminish. The high cost of finance is also causing inventory levels to be reduced on the grounds of affordability.

Exchange Rates

US and UK elections are likely to influence exchange rates significantly. The outcome of the UK general election is more predictable, and any uncertainty will relate to the changes in economic policy that a new government may choose to make or how manifesto pledges are delivered.

Crude Oil

The likely scenario is that Brent Crude will continue to trade in the 70 – 90 USD per barrel range, with energy companies trying hard to manage supply in an economic environment that will tend towards falling prices.

Notably, many traditional energy companies that have been heavily reliant on Crude Oil sales have increasingly diversified their sources of revenue, with many now turning more to renewables for sustainability, both for the planet and their business models.

Feedstocks

VCM (Vinyl Chloride Monomer)

Energy costs and price/demand for Caustic Soda will have a significant bearing on VCM economics and the price of C2. Increased US PVC capacity will likely result in increased imports of S-PVC resin, which will tend to cap monomer pricing.

PX (Paraxylene)

rPET pricing is expected to influence PX costs significantly, and the different economic structures of r-PET can cap prime virgin PET pricing and, therefore, impact PX pricing. External factors such as demand for fibre applications, along with weather conditions, will be of influence in terms of the supply-demand balance.

C2 (Ethylene)

Ethylene pricing is likely to be heavily influenced by PE imports from the USA, which are expected to increase further in 2024 and keep C2 pricing at relatively low levels.

C3 (Propylene)

C3 has a double reliance on crude oil refining in which C3 is a significant co-output of Naphtha cracking for ethylene and also a byproduct of the FCC (Fluidised Catalytic Cracking) process used to upgrade the petroleum fraction of crude oil distillate to the required environmental standards. Whilst the ratio of C2 to C3 in the Naphtha cracking process can be adjusted, this is within a relatively narrow window. Therefore low C2 demand along with refinery output rates will impact C3 availability. Demand for petroleum will likely be reduced through the increased use of EVs. Recovery in C3 demand to make polypropylene required for consumer durables could tip supply/demand back in favour of the producers. In turn, this could lead to some cross-subsidy of C2 derived from Naphtha cracking.

Benzene

This is an important aromatic hydrocarbon compound which is the basis for the following intermediates including:

- Ethylbenzene

- Cumene

- Cyclohexane

- Nitrobenzene

- Linear Alkylbenzene

- Maleic Anhydride

- Others

Which Ethylbenzene, Cumene and Cyclohexane are precursors to essential monomers, including SM (Styrene-based polymers), Bisphenol A (PC) and HMXDA (PA66)

Price volatility is expected to continue, particularly as petrochemical producers seek to improve the economics of this important aromatic petrochemical compound.

Please click here to subscribe for free and receive monthly updates directly to your inbox.

To read more on Plastribution click here.