Polymer Price Know-How: September 2023

- Jess Clarke

- September 20, 2023

- 10 minutes read

The leading polymer distributor, Plastribution, has released the latest instalment of Price Know-How. Price Know-How helps plastic raw material buyers make informed purchasing decisions. This month, the market reacts to the widely-anticipated increase in contract monomer pricing, with many polymer converters having already increased inventories to resist accepting the price hikes.

Overview: September 2023

How will the market react to feedstock price inflation?

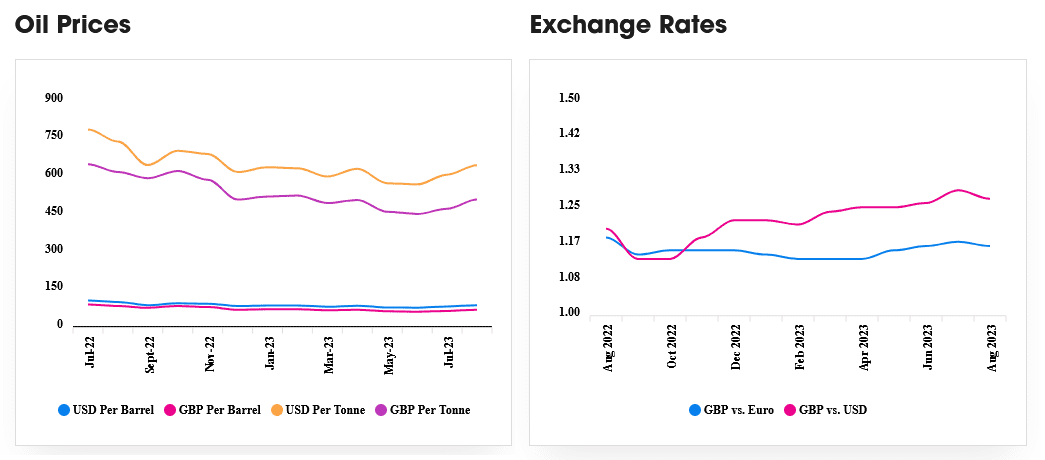

The September increase in contract monomer pricing was widely anticipated and is largely a result of firming crude oil prices and the consequent impact on energy cost. SM (Styrene Monomer) pricing was further enhanced by significant production restrictions resulting from a combination of planned and unplanned outages. The stimulus of input cost inflation has caused polymer producers to push for increases in excess of the hikes for the respective monomers.

Given that price increases were anticipated, many polymer converters increased inventories leading to a situation where converters are favouring the use of these inventories in order to resist accepting the price hikes. Furthermore, downstream demand remains subdued. In these circumstances it is likely that the supply demand balance will be the ultimate arbiter of price, and this is likely to come down to a material type and even grade level; by way of example supply of LDPE MFR 0.3 currently is extremely tight resulting in greater opportunity for suppliers to push through increases.

Whilst the scale and timing of increases may lack certainty, it appears that for most volume polymers the market is at, or about the very bottom with future price movements expected to be level or upwards.

Any recovery in downstream demand, could push market fundamentals towards shortage with clear implications for prices.

The situation for more specialised materials continues to be rather weak, with sellers chasing available business and competing for market share. Some recovery in demand for mobility/automotive applications has not been matched with increased demand in the consumable durables and construction sectors and hence the on-going weak demand overall.

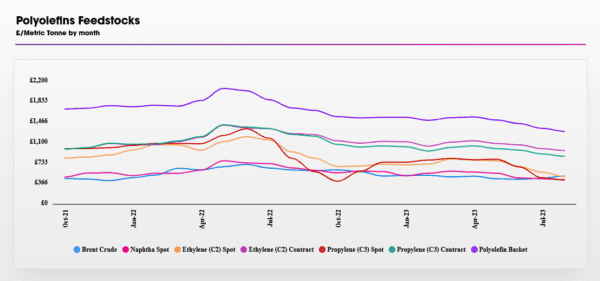

Polyolefins

After hitting the bottom of the market in August, the predicted price rises in September have come to pass but are varying quite significantly across the range of Polyolefin products. All PE grades have at least achieved the C2 monomer increase of €75 / MT with some grades moving beyond that due to restricted availability. However, whilst some producers of PP have sought increases beyond the C3 monomer increase of €60 / MT, most are going with monomer and those with excess product are agreeing to increases of €30-40 / MT to try and move stock.

With PE, we’re seeing the effects of reduced output in the Middle East following several turnarounds and stoppages. USA producers looking for increased prices locally and this is limiting buying interest from Europe accordingly. Demand in PE has improved slightly with seasonal factors improving consumption in some sectors. Supply is now much more balanced with stronger buying interest helping the price increases to be passed through without much opposition. Some grades, such as LDPE are reported as tight.

PP is not in as strong a position and demand continues to be poor with supply relatively ample. One producer has taken the decision to close an old PP line in Europe. Whilst this is a relatively expensive undertaking, Europe, has on average, the oldest plants in the world (nearly 30 years old) and with the high running costs associated with keeping them going, some are now unsustainable. The effects of this could be felt in 2024.

Outlook beyond September is unclear, there is already talk of further increases in monomers based on rising oil prices and Naphtha. However, Global demand continues to poor, and all eyes will be on China and their usage. If we see an uptick in demand, then further increases are likely but without that, a rollover in October becomes more likely.

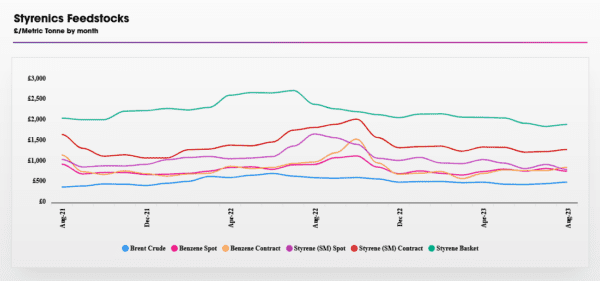

Styrenics

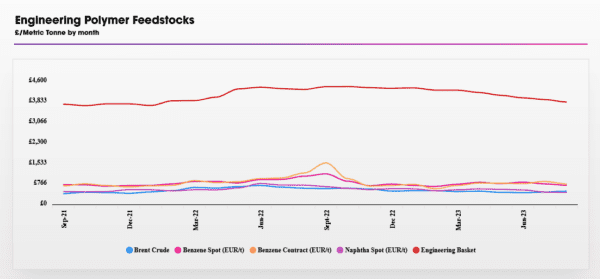

Engineering Polymers

Price Know-How: September 2023 Full Report

Visit the Price Know-How website to read the September 2023 update, including an in-depth analysis of each market segment and material group by Plastribution’s expert product managers.

Subscribe and keep in the know.

Price Know-How is an industry-leading report to keep you updated on polymer pricing and market fluctuations. A trusted, go-to resource for over a decade, Price Know-how is produced by the thermoplastics experts at the leading polymer distributor, Plastribution, with data from Plastics Information Europe.

Unlike many pricing reports, Price Know-How is tailored specifically for the UK polymer industry. We do all the currency conversions, so you don’t need to!

To subscribe for free and receive monthly updates directly to your inbox please click here.