Plastribution’s Polymer Price Know-How: May 2025

|

Getting your Trinity Audio player ready...

|

Plastribution’s May Polymer Price Know-How reflects continued downward pressure on polymer prices, despite oil hitting a four-year low and monomer costs falling sharply. The market remains cautious as global trade tensions ease, but consumer confidence is yet to recover. While some converters look to secure low-priced stocks, producers are reducing output in response to high inventories and weak demand. The outlook remains subdued, with economic sentiment and over-supply weighing heavily on recovery prospects.

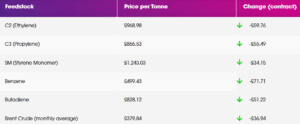

Crude Oil prices, a key indicator of global economic confidence, have recently fallen to a 4-year low as concerns continue about President Trump’s US import tariff policies. As can be seen in the table above, most monomer prices fell by a greater extent. The reaction to falling feedstock costs has been slightly muted in terms of polymer prices, but the downward pressure continues

The impacts of a limited agreement between the UK and the US, along with a major de-escalation of the tariff war between China and the US are yet to be seen, but consumer confidence has been dented and will not recover easily.

Many converters of standard polymers appear to be contemplating the opportunity to secure low value stocks, prior to a turn-around in market conditions. Polymer producers appear to be chocking output rates due to operating losses, high stock levels and poor demand. It may still take some time for market conditions to become more favourable due to abundance of product and weak economic sentiment.

Monomer Price Movement

Exchange Rates

Exchange Rates

€- 1.17

$- 1.31

€/$- 1.12

Polyolefins

After the uncertainty of April with the potential backdrop of a Global Trade War, we have a little bit more clarity in May as the potential for retaliatory tariffs on US imports has abated, at least for the time being.

As we’ve seen, the turmoil has impacted oil prices, this is reflected in Naphtha and has led to monomer drops in May. C2 Ethylene dropped by €70 / MT and C3 Propylene dropped by €65 / MT. For the most part, we’re seeing polymer prices follow this but there are some differences appearing depending on the approach taken in April and the availability of certain grades. On PE, some producers kept with the rollover announced at the start of April anticipating disruption to supply with the expectation of retaliatory tariffs temporarily halting shipments from the US. With supply more assured in the medium term, some producers are offering small incentives beyond monomer to encourage buying.

There are some short-term pockets of supply disruption as imports were temporarily suspended, this is mostly affecting LLDPE and HDPE, but the longer-term outlook is for strong supply into the summer.

PP is also seeing stronger levels of imports soon as the market adjusts to the disruption caused by the trade war between China and USA. There may be more disruption depending on how China manages to supply the PP plants that have relied on imports of propane from the USA.

The £ has strengthened a little against the € and this should also help a little with prices.

Styrenics

Contract EU Styrene falls again.

Styrene Monomer has fallen by €40/T, settling at €1456/T.

For May, EU GPPS and HIPS reduced by €40/T and EU ABS followed (+€50/T). Non Flame retardant Import ABS Rollover. FR ABS facing increases due to FR Shortage.

GPPS/HIPS/ABS supply chains are still running at reduced rates, no doubt triggered by low demand. Converters and distributors are also running inventory at very low levels due to financial pressures. Therefore, any adjustments in polymer prices are likely to be passed on immediately.

Engineering Polymers

April saw disappointing sales across most materials and market segments. There was renewed efforts to try to push increases through for the start of Q2, however with weak demand most producers had to accept rollover at best.

The April benzene contract settled €179/Mt lower than March and May sees a further decline of €84/Mt settling at €585/Mt.

Sustainable Polymers

Recycled Polyolefins has seen a mixture of price movements in May with some grades showing tight supply increasing in price, but most moving in a similar direction to prime grades with reductions differing depending on supply and demand balance.

Recycled LDPE / LLDPE

Some recycled LDPE / LLDPE increased a little in May as input costs of bales increased and with good quality material still in high demand to meet legislative and consumer requirements, recyclers felt confident in passing through increases. More industrial grades were under pressure to follow the prime price reductions seem of around £50 / MT but there was some resistance, and reductions were typically lower as input costs for recyclers remain high.

Recycled HDPE

Recycled HDPE has mostly rolled over in May, high input costs continue to put recyclers under pressure and whilst prime prices are coming down, recyclers are not able to absorb costs, and many are at a breaking point with regards to profitability. Some movement depending on the quality and the supply / demand balance. Natural grades continue to command a strong premium over prime

Recycled PP

Recycled PP has seen around rollover in May, after coming under pricing pressure in April, recyclers have no more to give and with input costs staying relatively high. Demand for natural recycled PP for consumer goods is still quite strong, and prices are staying high. Industrial grades are under some pressure as demand from key sectors is still weak.

Price Know-How: May 2025 Full Report

Visit the Price Know-How website to read the May 2025 update, which details each market segment and material group produced by Plastribution’s expert product managers.

Subscribe and keep in the know

Price Know-How, a decade-long trusted resource in the industry, provides essential updates on polymer pricing and market dynamics. This report is crafted by Plastribution, a leading polymer distributor, in collaboration with Plastics Information Europe.

Price Know-How is tailored specifically for the UK polymer industry, unlike many other price reports. They do all the currency conversions, so you don’t need to!

Please click here to subscribe for free and receive monthly updates directly to your inbox.

Read more on Plastribution here.