The latest polymer price reports and charts have been released by Plastrack.

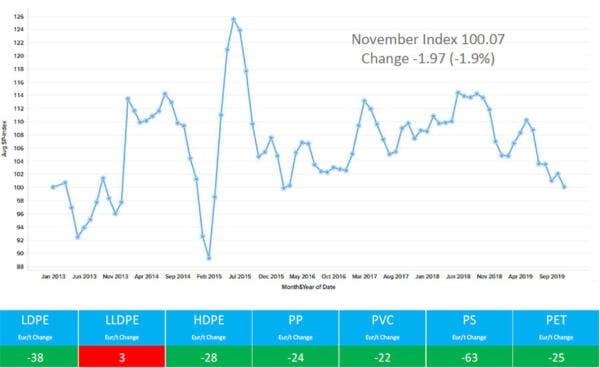

Standard Thermoplastics Trends November 2019:

Ethylene (C2) Feedstock – in November, prices decreased by Eur 28/mt on the back of decreasing naphtha and oil prices. Demand continues at low levels, particularly in the run-up to year-end. Supply is at normal levels. Prices are expected to be stable in the coming period.

Propylene (C3) – In November, prices decreased by Eur 28/mt reflecting reductions in naphtha and oil pricing. Demand continues at low levels particularly in the run-up to year-end. Supply is at normal levels. Prices are expected to be stable in the current period.

LDPE, LLDPE, HDPE – prices decreased across the board in the period due to the change in the monomer feedstock pricing level. Demand and supply are at normal levels. Prices are expected to be stable in the current period.

PP pricing decreased by Eur 24/mt in the period following a fall in the propylene monomer price. Supply is at normal levels but demand is subdued. Predictions are of further falling prices in the coming period.

PVC pricing decreased by Eur 22/mt in the period. Demand and supply are at normal levels. Price stability is expected in the coming period.

Styrenic prices decreased by Eur 63/mt in the period driven by further reductions in styrene monomer prices. Supply is on the high side with large stocks in the supply chain; however, demand is at low levels. Further price reductions are predicted in the coming period.

Engineering Thermoplastics Trends November 2019:

Benzene feedstock pricing decreased significantly by Eur 153/mt in the month of November. Continued weak demand from Styrene is causing a lower than normal demand level offset against a normal level of supply. Prices are expected to increase in the coming period as demand (particularly from styrene) returns to more normal levels.

PC prices fell by Eur 58/mt in the month of October driven by subdued demand levels and normal levels of supply. The slowdown in the automotive sector continues. Prices are expected to decrease in the coming period with no predicted demand-side improvement.

PA6 pricing reduced by Eur 36/mt in the period. Supply is at normal levels; however, demand continues to be very low (particularly automotive sector). Forward pricing is expected to continue to reduce with no visible signs of demand recovering to more normal levels.

PA66 pricing decreased by Eur 34/mt in the period. The demand situation remains very low, with no signs of recovery in the automotive sector on the horizon. Supply remains at high levels with significant stocks building in the supply chain. Price reductions are predicted to continue in the coming period.

PBT pricing reduced by Eur 75/mt in the period. Supply is at normal levels however demand continues at low levels. Further price reductions are predicted.

POM pricing reduced by Eur 37/mt in the period. Supply is at normal levels however demand continues to be lower than normal. Prices are expected to continue to fall in the coming period.

PMMA pricing reduced by Eur 59/mt in the period. Supply is at normal levels with demand continuing to be low. Further price reductions are predicted in the coming period.

Plastrack Polymer Price Index

Plastrack is a web-based tool which can be accessed by desktop, tablet, or mobile and provides pricing data on the most common feedstocks and polymers. Prices are updated on a monthly basis based on information obtained by Plastrack researchers directly from plastics producers, traders, distributors, and converters. Visit Plastrack’s website for more information.