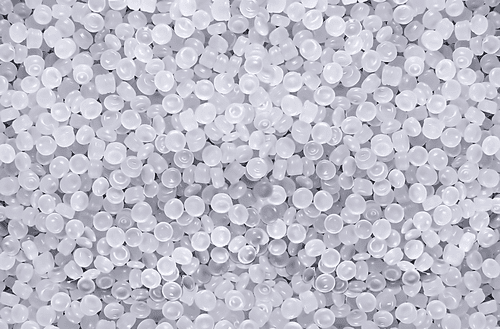

The latest polymer price reports and charts have been released by Plastrack.

Standard Thermoplastics Trends November 2018:

Ethylene (C2) Feedstock – in November prices fell by Eur 108/mt. This significant price fall has been driven by reductions in crude oil and naphtha. Supply is at normal levels although demand is still suppressed by the low water levels on the river Rhine.

Propylene (C3) – in November prices fell by Eur 96/mt. Reductions in oil and naphtha have driven the lower pricing levels. Supply is at normal levels although demand is still weak attributed to the low water levels on the river Rhine.

LDPE, LLDPE, HDPE small price reductions continued to trickle through in November. Supply and demand were at normal levels.

PP pricing decreased by Eur 7/mt in November due to significant competitive pressure from producers fighting for volume sales. Demand is at lower levels (the predicted significant fall in C3 prices meant that buyers were more careful with purchases).

PVC pricing levels decreased by Eur 6/mt in November. Supply and demand are at normal and balanced levels. The low water levels on the river Rhine are causing some production restrictions and a significant fall in producer inventories.

Styrenic prices experienced a significant Eur 147/mt decrease in the month on the back of further significant falls in styrene monomer pricing levels. Demand and supply are normal and balanced.

Engineering Thermoplastics Trends November 2018:

Benzene feedstock pricing decreased significantly by Eur 146/mt in the month. This decrease is driven by falls in oil and naphtha pricing. The market remains over supplied with high inventory levels and lower demand caused by the water levels in the river Rhine.

PC prices reduced by Eur 55/mt in November. Supply is at normal levels but demand continues to be low (particularly from the automotive sector).

PA6 pricing fell by Eur 28/mt in November. Supply is at normal levels but demand (particularly from the automotive sector) is weak.

PA66 pricing was largely stable in the month with only a slight Eur 2/mt reduction being seen. Supply continues to be very tight with no improvement being seen. Demand is at lower levels (mainly due to lower automotive demand).

PBT pricing averages increased slightly by Eur 3/mt in November. Supply is at normal levels but demand is low (due to lower demand from the automotive market).

POM pricing increased by Eur 3/mt in November. Supply is at lower levels attributed to the river Rhine situation and demand is low (attributed to lower demand from the automotive sector).

PMMA pricing was stable in the month. The river Rhine situation supressed supply levels but the market was balanced with lower levels of demand being experienced (particularly from the automotive sector).

Plastrack Polymer Price Index

Plastrack is a web based tool which can be accessed by desktop, tablet or mobile and provides pricing data on the most common feedstocks and polymers. Prices are updated on a monthly basis based on information obtained by Plastrack researchers directly from plastics producers, traders, distributors and converters. Visit Plastrack’s website for more information.